I. 글로벌 항공 산업에서 좌석 효율성이 갖는 경제적 의미

In this market, airline profitability is not primarily determined by fleet size or flight frequency, but by how efficiently fixed cabin space is utilized. Aircraft cabin space is a finite resource—once the fuselage is built, it cannot be easily expanded.

A single change in seat layout can create tens of millions of dollars in annual revenue difference per wide-body aircraft.

This impact becomes especially pronounced on long-haul routes, where premium cabins dominate profitability.

Premium seats are not merely a service feature; they are the economic engine of long-haul aviation. One business-class seat can generate more revenue than multiple economy-class seats combined.

However, conventional cabin design faces a structural limitation. Increasing seat comfort typically reduces seat count, while increasing seat density often degrades passenger experience—a zero-sum trade-off.

Seat efficiency innovation breaks this trade-off. By rethinking cabin space in three dimensions rather than two, airlines can increase premium seat capacity without modifying the aircraft structure.

This approach delivers pure revenue upside without proportional increases in operating cost. It transforms cabin layout from a cost consideration into a strategic revenue lever.

Ultimately, seat efficiency is not a design decision—it is a financial strategy. The moment cabin space is redefined, the economic value of the aircraft itself is redefined.

Steady growth (2010–2019): Global air travel demand grew steadily, reflecting the structural growth of the aviation industry.

Sharp decline (COVID-19 shock, 2020–2021): This period shows the historic collapse in air travel demand caused by the COVID-19 pandemic. This is visually represented by the sharp drop in the chart.

Recovery phase (2022–2024): Pent-up travel demand rebounded rapidly, and by 2024, global RPK surpassed 2019 levels by +10.1%. This means the market has already exceeded its pre-pandemic peak.

Forecast period (2025–2030): Global air travel demand is expected to continue growing, with a slightly slower growth rate but an expanding overall market size.

This chart compares baseline global aviation passenger revenue with a seat-efficiency improvement scenario (+12%) over time. Even with the same demand growth, improving seat efficiency lifts the entire revenue curve to a higher level every year. This implies an annual revenue gap of roughly $130B by 2030. This is not about cost-cutting.

It shows that cabin space efficiency directly expands the revenue base itself.

II. Why It’s a Game Changer – The Korean Air A380 Case

The upper deck cabin width of the Korean Air A380 is approximately 5.8 meters. Even with a generously wide central aisle of 1.2 meters, each side of the cabin can secure about 2.3 meters of usable seat-zone width.

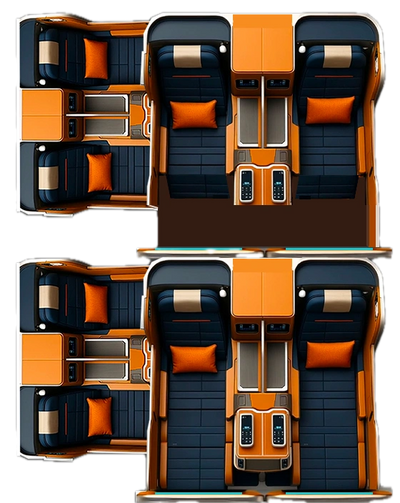

This provides the spatial conditions to design premium seating spaces longer and wider than any conventional premium product today. For example, within a footprint of 1.9 m (width) × 2.3 m (depth), a four-seat, space-efficient business-class module can be installed, offering more generous personal space than conventional business-class seats while increasing overall seat count.

In practice, Korean Air currently operates 94 business-class seats on the A380 upper deck. With the space-innovative seating architecture, up to 136 premium seats can be installed — a structural increase of approximately 45% without any airframe modification. Seat dimensions further highlight the improvement in passenger comfort.

While Korean Air’s current business-class seat measures approximately 188 cm in length and 53 cm in width, the space-innovative seating concept enables individual spaces of approximately 190–230 cm in length and 60–70 cm in width. With the same aircraft, the same routes, and the same operating costs, a new seat architecture alone can enhance both the premium passenger experience and airline profitability.

This is the “magic of spatial re-interpretation,” and why space-innovative seating on the A380 upper deck is regarded as a true game changer.